Using a Dining Room Table to Explain How Credit Cards Work in YNAB

I’ve been part of several YNAB Facebook groups for awhile - shout out to the group that I moderate called “YNAB (You Need a Budget) Chat and Support Canada”. The thing that I’ve noticed that seems to stump the most YNAB fans in these groups is credit cards. It just seems to be one of those elements that takes some folks awhile to “click”. So, if you are a credit card person (and I acknowledge that not everyone is a credit card person) and find credit cards a bit tricky to understand in YNAB, this post is for you.

A Dining Room Table, Cash, Envelopes, and a Yellow Pen

So what do a dining room table, cash, envelopes, and a yellow pen have to do with YNAB? Simply put, they are elements of the old-fashioned cash envelope method of budgeting. And YNAB, at its basic level, is an electronic version of the cash envelope method of budgeting. I frequently use the cash envelope system and the dining room table analogy with my coaching clients to explain the basics of zero-based budgeting and YNAB. It works well for those who are visual learners.

Think of the following scenario:

You work for cash and you’re paid every day. You’re a babysitter, a handy-person, you mow lawns. It really doesn’t matter what you do but you are paid in cash every day. Every evening, you come home after work with your hard-earned cash. You are using the cash envelope method of budgeting, so you ceremoniously (or perhaps unceremoniously) dump the cash on your dining room table.

In YNAB, the dining room is Ready to Assign, sitting at the top of your screen:

Since you are a diligent budgeter, you can’t leave your cash sitting there loose on the dining room table - heck no, you need to give these dollars a job. Sitting on your table is a series of envelopes each with a different spending or saving category written on them (rent, groceries, utilities, travel etc..). These envelopes are for things you will spend on this month or things you will spend on down the road. In YNAB, the envelopes are your categories:

You’ve written the amount you wish to set aside in these envelopes each month on the outside of the envelope. In YNAB, these are your targets:

The next day, you go to the grocery store. Before you go, you check the “groceries” envelope to see how much cash you have available to spend. In YNAB, this is the amount in the available column:

You then take the cash you need from your “groceries” envelope and spend it at the store. If you need to spend more than the amount of cash available, you would take cash from another envelope to cover the difference (after all, you only have so many dollars to work with). In YNAB, this is moving money from one category to another or covering overspending - depending on if you make the move before or after you go to the store.

Enter the Credit Card

The dining room table analogy above is pretty straightforward but YNAB users can sometimes get a little stumped when credit cards come into play. YNAB actually handles credit cards really well but it is a little different than how it would work if you were using a basic spreadsheet or other budgeting apps.

Going back to the above analogy, let’s pretend that you are using the cash envelope system and then one day you get a credit card. You add a new envelope to the mix called “pay the credit card” - this is to store the cash you need to pay this particular bill.

The next day, you go to the grocery store and spend $100. You pay using your new credit card. When you get home, you know that you’ll have to pay this amount to the credit card company so you take $100 from the “groceries” envelope and move it to the “pay the credit card” envelope. Then, when you go to pay your credit card, you take the cash from the “pay the credit card” envelope, go to the bank, and pay the bill.

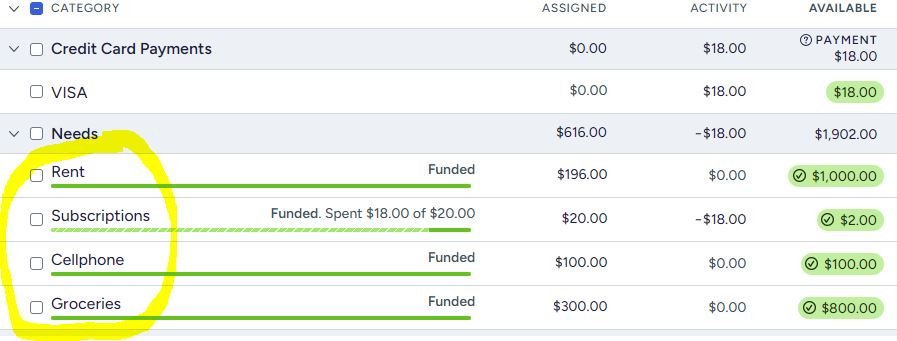

In YNAB, when you add a new credit card account you’ll get a fancy new category group called “Credit Card Payments” and a new category for your credit card, which you’ve named “Pay the Credit Card” (you could also just name this “credit card”, “visa”, or whatever you want).

Let’s say you spend $100 on groceries using your credit card. In YNAB, you would then enter the transaction and categorize it as “groceries”:

Then, on the budget screen (and here’s where people tend to get stumped), YNAB automatically moves the $100 from your “groceries” category to your “pay the credit card” category. Then, when you go to pay your credit card bill, the $100 is sitting in the available column of your “pay the credit card” category. It’s that simple .. beautiful budgeting indeed.

However, if you didn’t put enough money in the “groceries” category to cover the $100 charge, when you enter the transaction, YNAB will give you a yellow warning in your “groceries” category that looks like this:

You’ll need to cover the overspending in the groceries category by pulling from “Ready to Assign” or another category. Then, the $100 will be automatically moved to the “pay the credit card” category and the yellow warning will go away.

Overspending on a credit card doesn’t have an obvious good dining room table analogy - but you could picture yourself writing a reminder in a yellow pen on your “pay the credit card” envelope that you still need to add $100 to it to cover the bill. When you add the cash, you can cross it off.

Conclusion

So that’s it, a dining room table, envelopes, cash, and a yellow pen. If you were having a bit of a hard time wrapping your head around how credit cards work in YNAB, I hoped this has helped.

Don’t miss another new post! Subscribe to my newsletter where you'll receive money management tips, personal updates (including very cute Bella the Beagle content), and more!

Want to learn more about my money coaching programs? Check out my web site.

Interested in seeing how your finances stack up against the 50-30-20 rule? Download the Financial Fit Check, a free resource.